Flexible bioeconomy for future scenarios of biofuels

Author

Mahsa Mehrara,

Luleå University of Technology, Div. of Energy Engineering

Abstract

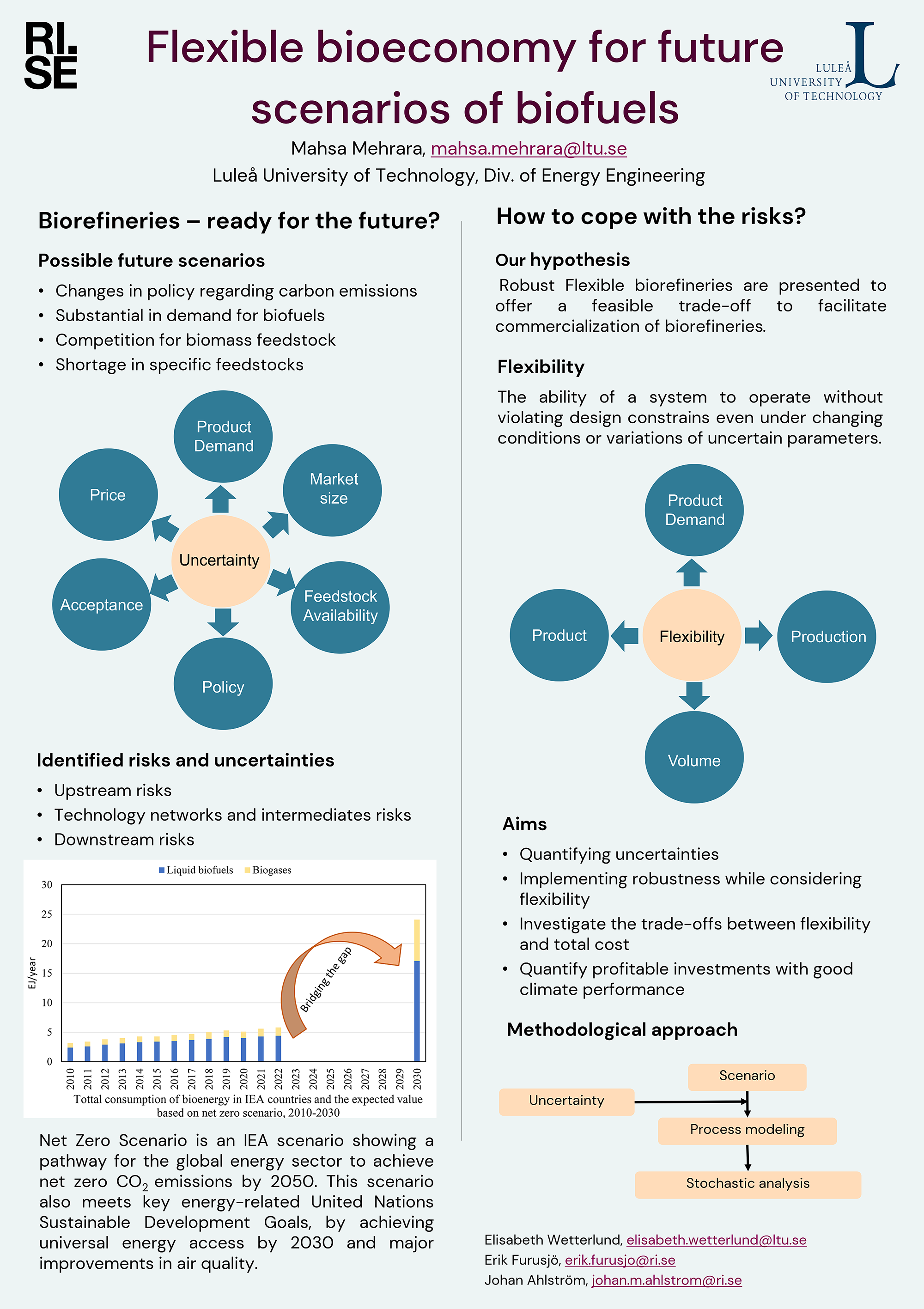

Transport sector, chemical industry, mining and steel industries, and cement industry are sectors that are possible major future users of biomass feedstocks. The chemical and steel industries are expected to see large-scale use of biomass feedstocks only in the medium to long-term. However, this transition is threatened by technical and market risks. Uncertainties caused by fluctuating market conditions or evolving environmental policies can affect operations and company performance. An often-considered solution for dealing with uncertainty is flexibility. Flexibility as a design attribute represents the ability of a design to tolerate and adjust to variations in conditions that may be encountered during operation.

This study aims to evaluate the robustness of bio-based value chains while involving the risks and uncertainties, to lower the risks associated with investments in biorefineries. These risks could be categorized in three main sections: upstream, technology networks and intermediates, and downstream. Upstream risks include, e.g., seasonality and prices of feedstocks, but also possible changes caused by unpredictable policy regulations, as well as public acceptance. Technology networks and intermediates risks include unstable market demand as in a scenario where the demand for biofuel increases, there will be a need for up scaling the plant. While also to ensure a profitable plant in a volatile market, it is of great importance to present a system with the ability to switch between production schemes to make the plant profitable in different scenarios. Downstream risks include variable quality and quantity demand in market while also uncertain environmental policies, e.g. controlled carbon emissions. The responding flexibility could be designing a biorefinery or modifying an existing biorefinery that is able to adapt to the identified risks. Different investment strategies can be envisioned when planning for flexible biorefineries – either implement flexibility pre-construction or modify existing biorefineries over time. These two

strategies come with different initial costs, and different risk exposures. Previous scientific literature shows a substantial gap regarding quantifying uncertainties and implementing robustness while considering flexibility. This work will identify and quantify profitable investments with good climate performance, assess their robustness under uncertainty, and investigate the trade-offs between flexibility and total cost. Researching the above questions could be a great step toward increasing the investments on large-scale biorefineries.